Finance Technology also known as FinTech is an ever growing industry which integrates technology to improve or automate finance services and processes. In this blog, we will cover top things you didn’t know about FinTech 2021.

Defining FinTech

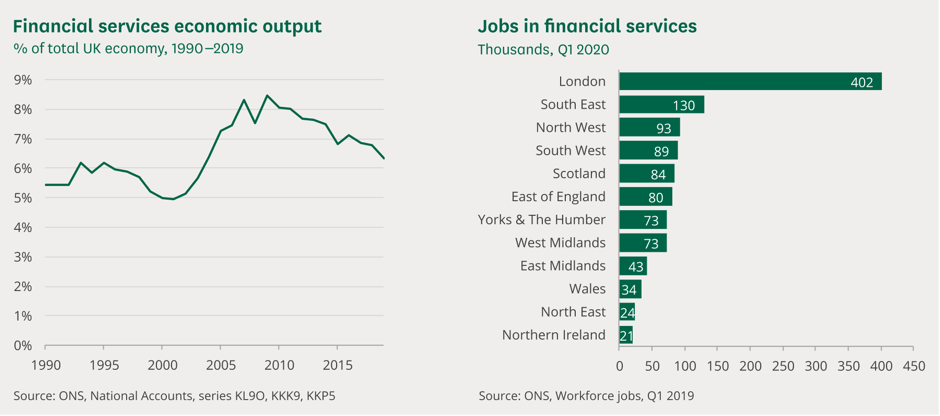

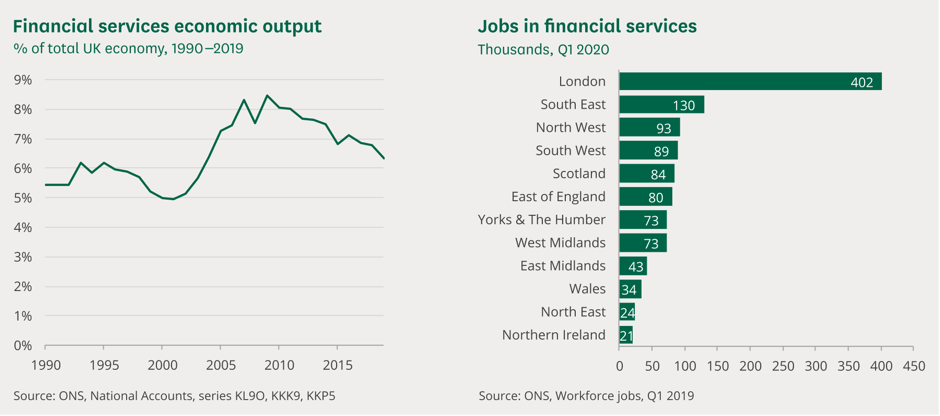

To fully comprehend what Financial Technology (FinTech) is, we must define Financial Services (FS). Financial Services are defined by oxford dictionary as ‘professional services involving the investment, lending, and management of money and assets.’ Financial Services is a sector made up of companies that provide finance related services and products. In addition to this, Professional Financial Services are a key part of the UK economy, utilised by all sectors provided through typical means and organisations. However, currently the impact it had during Covid-19 was crucial and it affected many businesses in this industry. In November 2020, the financial services sector claimed around £447 million under the furlough scheme up to 31 December.

Originally, traditional companies relied on labour intensive methods to create and supply financial services and products. As technology matured it has been utilised to improve the efficiency and effectiveness of those companies, and their existing products and services. Recent advances in technology and regulation has allowed technology centric companies to exist and this is where FinTech companies came to life.

So, to define Fintech in detail, it is an economic industry composed of companies that use technology to make financial services and processes more efficient. Offering variants of existing products and services, or new products and services, which are driven and enabled by technology to reduce labour time, cost and to be much leaner and agile in operation. The FinTech companies generally work under different business and operational models to the more traditional companies in the sector.

-Known FinTech companies

Uber– The world’s largest taxi company, owns no vehicles. It does however use apps and FinTech to operate a significant part of its business.

Airbnb– The world’s largest accommodation provider, owns no real estate, but uses digital practices and FinTech to operate.

Accessible Banking to Millions

Banking has not always been this accessible. Nevertheless, thanks to acts and regulations being established it has become much more open to the public.

An example of this is the Americans with Disabilities Act (ADA) which prohibits businesses from discriminating against anyone with disabilities. For financial and banking organisations, this means, among other things, that their services must be equally accessible to people with and without disabilities.

Of course, people with disabilities aren’t the only segment of the population that have a disadvantage when it comes to banking. Around the world, minorities, students, low income individuals and many more struggle with banking. Providentially, the development of Fintech services and products are aiming to address these problems by introducing digital financial services and solutions.

The following services and solutions are being established worldwide:

- Easier ways for securing loans – Tala: Accessible for people and businesses that have trouble securing loans because of low credit scores or a lack of a credit history. Venmo: Allows people to borrow money from and make payments to their friends without having to pay high-interest rates or transaction fees.

- Lower transaction costs – E-payments.

- Increased banking access for the disabled – Online banking.

- Easier banking options – Interactive Teller Machines.

- Better access to financial advice – Robo-Advisors, Chatbots, Omni-Channel etc.

And so much more…

Revolutionised the Loans Market

The concept of lending money has existed for many years and evolved over time. From political movements to technological evolution, the lending landscape has seen dramatic shifts, for better or for worse. In the following section, we will present a timeline of events in finance history.

1923 – The Chamberlain Housing Act of 1923

1924- The Wheatley Housing Act

1930s- The housing boom continued

1939-1955- The new era of housing in the UK

1950s-1960s- The rise of affluence in Britain

1950s-1970s – The launch of credits cards

1962- The Education Act

1958- The launch of BankAmericard

1966- The introduction of the first credit card in the UK

1967- The first ever cash machine was installed in the UK

1970s-1980s- Should I rent or Should I buy?

1973- Computerised credit card transactions

1980s- The UK moves to issue VISA and Access Cards, Online Lending, Parental Income and maintenance loan

1990- The emergence of ‘Cashback’, The establishment of the student loans company, houses prices increase dramatically

1995- The introduction of ‘Gold Cards’

1997- The start of tuition fees for students

2000s- Mobile banking and alternative lending, Wales and Scotland tuition fees

2004 – New higher education act

2007- The first contactless credit card payment

2008- The economic crisis and housing

2009- Housing after the economic downturn

2012/13- Tuition fees rise again

2017/18- Inflation raises tuition fees once again

All these events have contributed to the innovations created by FinTech. Fintech has changed the lending process by enhancing the financial services and products provided to the public. The following services now exist thanks to FinTech:

- Alternative lending models

- Fast approval and funding

- Making use of data- To get a more comprehensive picture of a consumer instead of relying solely upon traditional credit score.

- Offer perks and savings methods

- Blockchain

- Online banking

Financial Crimes within FinTech

Even though banking is now more accessible to people, discarding the traditional banks brings risks. Statistics show that 2 billion of the population are still not on broad with mobile banking and this could be one of the many reasons why. We want to hear your thoughts on this, are you on mobile banking? If so, why?

To add to this, there are several financial crimes that have been realised such as; money laundering, fraud, identity theft, terrorist financing on FinTech platforms using developing technology and the list goes on. These crimes are still happening until today however, the security system within FinTech is slowly becoming stronger. Meaning people’s financial data is being protected. Fintech innovators have enhanced the current security by inventing a payment system enabled with, network tokenization, OTP, SCP and biometrics to pacify the customer’s sceptical questions on the security. So, the question is. Do you feel safer using FinTech?

This year 2021, the compliance issues will be addressed even more explicitly to keep all the account information under user’s control. For this reason, open banking is being delayed by regulators to not compromise on ethics that might make matters worse.

FinTech Regulation

The question of how FinTech is and should be regulated is currently the subject of much debate. Fintech is regulated by many people for example: numerous government regulators, self-regulators, market regulators etc. due to the complexity it holds and purpose. The risks involved in the integration for these technological creations with existing business models are essentially high. For this reason, financial services are one of the most heavily regulated sectors in the world.

Throughout this blog, you have been presented with several examples of how Fintech has been used to develop a selection of financial services and products worldwide. So, you should understand how difficult it may be to regulate this sector and why there is a never-ending debate about it. There is no single regulator at this moment for Fintech businesses although, most FinTech businesses fall under the purview of the RBI.

AI Advances in FinTech

Don’t we all love transformation, innovation and growth? The advances in Artificial Intelligence (AI) in the Fintech market have been rising significantly during the past few years. By the end of this year 2021, it is predicted to reach £20 billion. By developing smart solutions, financial businesses get ahead of competition to cope with the ever-changing industry.

Artificial intelligence has changed the game dramatically for Fintech businesses worldwide. Currently, Fintech apps have been utilised more broadly to benefit individuals and businesses by providing useful tools such as; Chabot’s that address customers’ banking queries, fraud prevention tools for verifying the authenticity of KYC (know your customer) documents and analytics engines for analysing large volumes of data. All these advances have improved the accuracy, security and personalisation of financial services and enabled individuals to better access their personal financial products. Ultimately to improve people’s financial well-being and support those who are keen to stay on top of their finances.

Lubaina Manji, senior programme manager of Open Up Challenge 2020, Nesta Challenges, told The Fintech Times in November 2020. “In 2021, we expect AI to become even smarter, with more sophisticated chatbots and advanced functionalities—including switching utility and credit providers—as well as fraud prevention becoming the norm.”

The potential for Artificial intelligence use in FinTech will continue to grow significantly as new developments are being looked at by innovators, regulators and so many more people to enhance and form better and smarter solutions for the future financial services. Increased demand for process automation is one of the major requests for artificial intelligence in financial businesses. However, it is further evolving into cognitive process automation, where AI systems can perform even more complex automation processes. Meaning the future of Fintech businesses is unclear but exciting, don’t you think?